Irrespective of the fact whether your income falls under the tax exemption limit or not, the employer must issue a Form 16 if they have deducted tax at source.įorm 16 helps you easily file your income tax returns.

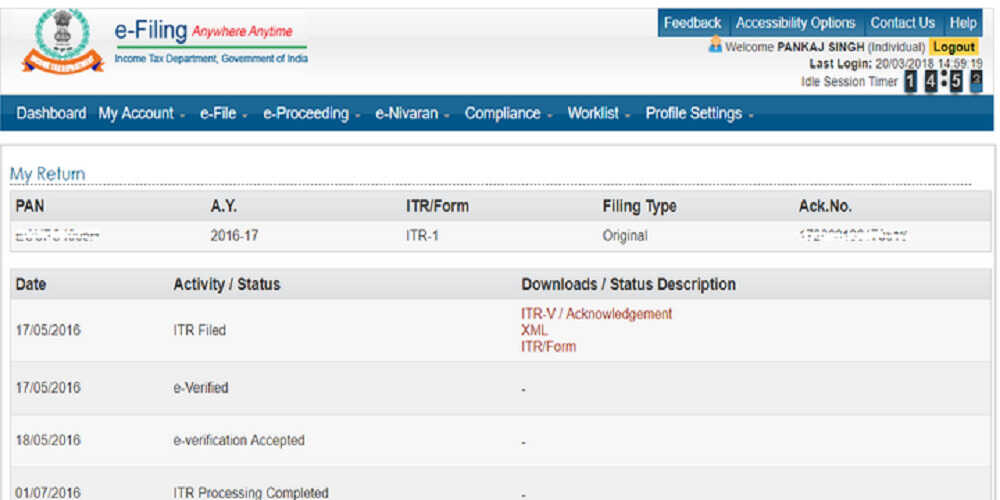

Form 16 EligibilityĪny salaried person whose tax has been deducted by the employer at the source is eligible to get Form 16. However, if your employer(s) did not deduct any tax at source from your salary, considering your income for the year is below the tax-exemption limit, they may not issue Form 16. If you have switched jobs during the year, or worked with different employers at the same time, and tax has been deducted at all places, you must obtain a separate Form 16 from each one of them. It details how much tax the employer deducted and when it was submitted to the IT department. What is Form 16?įorm 16 is a certificate (issued under section 203 of the Income Tax deducted at source (TDS) by the employer and submitted by them to the Income Tax Department (IT Department). Here's a quick look at income tax Form 16, and how it can help you file your ITR easily. Form 16 is one of the most common financial documents you would come across when filing your ITR.

It is that time of the year when you frequently get reminders from the Income Tax Department to file your income tax returns on time.

0 kommentar(er)

0 kommentar(er)